A Semi-Critical Look at Hingham Institution for Savings (HIFS)

One of the best run banks in the US looks very cheap right now, by historical earnings and P/B ratios. Is it really?

Intro

Banks can be very complex businesses. JPMorgan’s annual report is 328 pages long, and any of them could theoretically hide a nasty surprise - it’s understandable that many value investors feel apprehensive about them.

But banks don’t need to be complicated. At their core is a very simple idea - take deposits at a lower interest rate, make loans at a higher interest rate. Hingham Institution for Savings proudly embraces that simplicity, with a fantastic management team, an incredible track record of low-risk lending, and one of the best historical efficiency ratios in the industry. At just 6-7x 2021’s earnings, and a P/B below 1 for the first time since the GFC, they certainly appear attractive. However, with high short term rates and a long-duration, low-yield loan book crushing their NIM margin at the moment, can we expect to see them return to historical returns on equity any time soon?

Business Overview

HIFS is a small 190 year-old community bank, with $4.5b in assets and $2.35b in deposits, operating primarily in eastern MA/Boston and Washington D.C., and to a lesser extent San Francisco - all dense coastal cities with favourable demographics, substantial wealth, and supply constraints. Their loan portfolio is 81% commercial real estate, 14% residential real estate, 5% construction and < 1% commercial and consumer - so more than 99% mortgages. They explicitly do not engage in ABL, leasing, credit cards, auto lending, secondary market mortgage origination, wealth management or insurance-related activities. In general, their approach is to accept a slightly higher deposit cost in order to reduce personnel spend required to maintain and grow deposits. HIFS is notable for its high ROE, low efficiency ratio and excellent credit quality.

They are a part of the Massachusetts Deposit Insurance Fund (MDIF) which insures 100% of their deposits in excess of the $250,000 FDIC limit, meaning they do not face the liquidity risks which caused the failure of several regional banks in March 2023. HIFS is the only publicly traded bank with unlimited deposit insurance.

History

Going into the 1990s, HIFS was a struggling, poorly-run bank, with rapidly declining equity, large charge-offs, and the FDIC looming over. In 1993, Robert Gaughen, a minority shareholder and director, won a proxy fight for control over the bank, and began to turn it around. NPAs dropped by >90% in 2 years, and deposits and loans began growing at double-digit rates.

Robert Gaughen remains CEO and Chairman to this day, and the growth has continued. Since YE93, loans have grown from $77m to $3.81b, a CAGR of 14%, while deposits have grown from $118m to $2.42b, a CAGR of 11%. During this time, credit quality has remained pristine, even through the global financial crisis:

Management

Hingham’s shareholder letters are some of the most candid and insightful I’ve had the pleasure of reading. Their ‘22 letter begins…

Although we strive for them, not every year will be an outstanding one. Our results in 2021 were extraordinary, with our lending, deposit, and investment operations firing on all cylinders. We noted at the Annual Meeting last year that our results in 2022 would likely be much more modest in comparison. They were.

It goes on to detail exactly why their results have suffered in 2022:

Our business generates returns for our owners through the efficient transformation of maturity, using deposits and borrowings to fund a loan portfolio composed primarily of mortgages secured by multifamily residential properties. During normal economic conditions, the yield curve - a graphical representation of interest rates on debt for a range of maturities - has a positive slope and we benefit from turning short-term deposits and borrowings into somewhat longer term mortgages. From time to time, for reasons beyond the scope of this letter, the yield curve “inverts” and short-term interest rates are higher than long-term interest rates. We are currently in the midst of a significant inversion. Yield curve inversions will occur and although they are challenging for our liability sensitive model, they are also temporary and they do not cause us to question our approach. We did not, however, foresee the speed and intensity of this inversion and our financial results have suffered as a result.

Later in the letter, Gaughen even invites any talented deposit bankers in their area to give them a call, which just smacks of Buffett to me. I would advise any value investor to read the full letter, available here. He also quotes Buffett in their slides each year: “Banking is a very good business, unless you do dumb things”, and doesn’t entertain Wall Street with earnings calls or guidance.

Their management approach is conservative, patient and very deliberate, in a family-run kind of way (and indeed, Bob’s son Patrick Gaughen is president & COO, and future CEO). Their entrances into both D.C. and San Francisco were calculated moves, planned years in advance, and built up gradually to avoid any large errors. Management’s focus is firmly set on the long term value of the business, over short-term performance.

It may then come as little surprise that the bank keeps an equity portfolio, managed under a value investing philosophy:

Additionally, the portfolio included $65.2 million in marketable common equity securities. The Bank’s marketable common equity securities are not viewed as a source of liquidity and are managed to produce superior returns on capital over a longer time horizon. The Bank’s process is focused on identifying businesses with strong returns on capital, owner-oriented management teams, good reinvestment opportunities or capital discipline, and reasonable valuations.

This strategy has been successful, with the portfolio returning an annualised 14.4% over the past 8 years by my calculation - exceeding the S&P500’s 13.9%, and better than the vast majority of value investing funds over the same period. Maybe Gaughen should be a hedge fund manager instead…

Performance

Hingham’s return on equity and efficiency ratios have been exceptional over the past 2 decades, excluding the last year.

Their efficiency ratio has consistently sat 20% lower than their peers’/the nationwide average, and the gap has widened in recent years. This is the main driver behind their impressive return on equity, which has generally sat at around 15% in normal times. They are able to achieve such low expenses due to two factors. First, an outstanding team - they hire a small number of excellent bankers (with just ~90 employees, their assets per employee is 4x the national average) and pay them handsomely to keep them on for the long haul. In banking, it’s possible to swap quantity for quality more effectively than in many other industries, as good bankers can be trusted with much larger transactions. Second, they do not focus on attracting a particularly low-cost deposit base, as other banks do - in Q3’23, their average deposit cost was 3.13%, substantially higher than the industry average of 2.03%. More on this later.

Is now a good time to buy?

For stable businesses such as HIFS, a Peter Lynch chart is a useful tool - we plot the stock price against a certain multiple of (normalised) earnings (typically 15, though I’m using 12 here to be conservative) to see visually when the best times to buy are. For simplicity, I’ve used a 3-year trailing average to normalise earnings. The book value per share is also plotted.

Arguably, this is clearer if we just plot the ratios:

These charts suggest the present valuation is an attractive buying point, all else equal. Neither the P/B nor the trailing P/E have been this low since the GFC, and the average 5-year return for periods since 2000 where the P/B is below the current level of 1 is 20%, not including dividends.

Of course, all else isn’t equal - let’s look at the headwinds that have created this opportunity.

The other side of the story

Falling Deposits and Rising FHLB Advances

FHLB advances are loans offered to banks by the Federal Home Loan Banks (or FHLBanks), a consortium of 11 banks across the US which are privately funded but overseen by a government organisation, the FHFA. These loans range in duration from overnight to 30 years, with both fixed and variable structures, and require the borrower to put up real estate collateral with a 20-30% haircut. Interest rates on FHLB advances tend to sit just a few tenths of a percent than the equivalent treasuries, making them attractive as a stable source of funding.

This chart shows their deposits (split into retail and wholesale), FHLB advances, and equity over time, which approximately sum to assets (there are other liabilities which make up < 1%). A clear shift can be seen, beginning around Q4’21, as loan growth accelerates, funded primarily by increases in FHLB advances. At Q4’23, FHLB advances made up almost 38% of assets, which is very unusual in comparison to other community banks, though still a decent margin below their credit allowance of 51% of assets.

Over the same period, they’ve seen deposits fall by $43m. However, it’s important to differentiate between retail and wholesale deposits here. Retail deposits have risen by $152m (though are still down from a peak in Q1’23), while wholesale deposits (brokered CDs and listing service deposits) have fallen by $185m. This is less problematic, as these wholesale depositors do not represent a core customer base, but rather a more expensive wholesale funding source where competition is almost entirely rate-based - the decrease was the result of an intentional choice by management, as wholesale deposits became more expensive relative to FHLB advances.

In general, Hingham’s willingness to rely on FHLB loans and wholesale deposits, thereby avoiding having to hire a large deposit team and spend heavily on marketing, is an important contributor to their extremely low efficiency ratio. This has served them well over the last 3 decades, but in 2021 they made what I deem to be quite a severe mistake. Between Q1’21 and Q2’22, assets increased by $1.15b, funded primarily by the aforementioned increase in FHLB advances. At the time, this probably seemed like a great deal - with short term FHLB rates were near zero, they were able to grow their loan book with high quality loans, cheap funding and very little effort; but 2 years on, those advances have rerated to 4.68%, on average, eating up the entire spread - and HIFS must now gradually switch them out for deposits, or just wait for rates to come back down.

As painful as this is for shareholders, it should be understood that these are not high-risk liabilities - there is no precedent for FHLBanks refusing to lend to an otherwise stable bank (in fact because the significant haircuts seen on collateral virtually guarantee their safety, the FHLB has been criticised for being too willing to lend to weak banks), and while $785m of these advances are callable by the FHLBank within 6-12 months, there is no incentive to do so in a falling rate environment, given that the terms on these are 4 years or longer. It’s true that riskier/weaker banks are more likely to rely heavily on FHLB loans; however this reliance is generally not the cause of the weakness but a consequence.

An Inverted Yield Curve

As Bob Gaughen nicely explained in the letter, HIFS makes money largely by maturity transformation, relying on the typically upward-sloping yield curve to earn a net interest margin (NIM). While this is not unusual, as deposits tend to have shorter terms than loans, HIFS is much more liability sensitive than the average bank - estimating a 100bps rise in the fed funds rate to have a 25% impact on NIM at the current time (though it’s important to note that’s on an already compressed NIM).

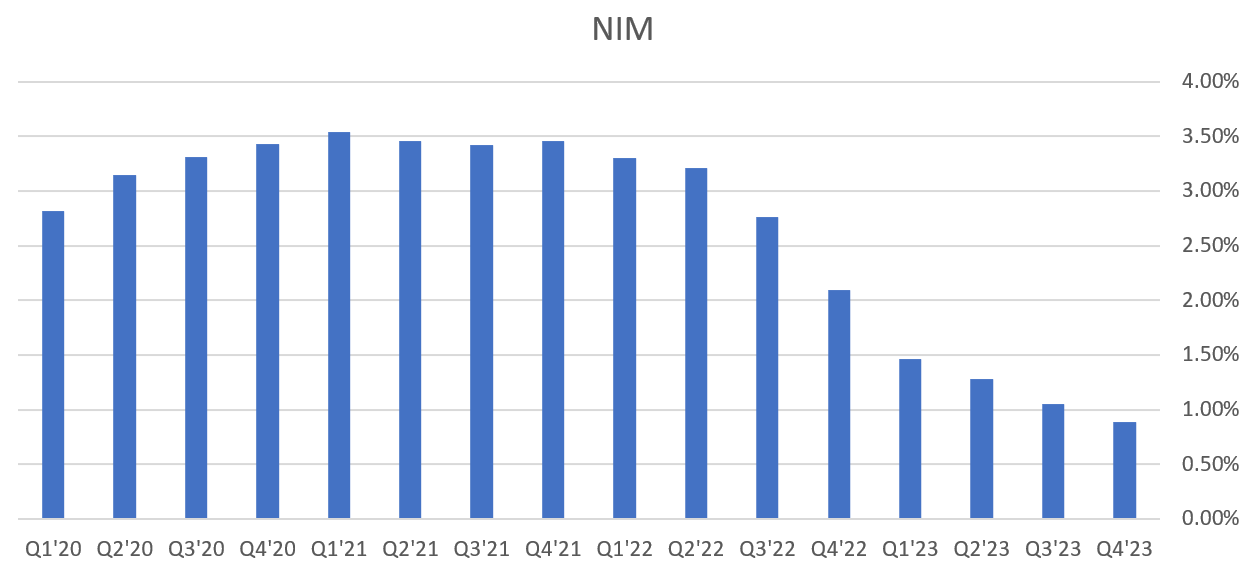

As a result of the rapid rate hikes implemented by the US Federal Reserve in order to combat inflation, the US is facing its most severe and protracted yield curve inversion since the 1980s. This has had a severe effect on their NIM:

On this subject, Bob wrote:

Yield curve inversions will occur and although they are challenging for our liability sensitive model, they are also temporary and they do not cause us to question our approach. We did not, however, foresee the speed and intensity of this inversion and our financial results have suffered as a result. Our balance sheet will adjust and although we will benefit from lower short-term rates eventually, we cannot count on on their quick arrival. This adjustment may take some time, given our focus on primarily fixed-rate multifamily real estate lending, and we believe that 2023 will be a challenging year. As we have repeatedly discussed, the most dangerous response to short-term challenges is to make changes that have long-term consequences.

So, the question then becomes, how quickly will their NIM recover, and will it be fast enough to ensure a good rate of return for the equity holder from this point? To answer this, I’ll consider separately how the asset and liability sides should rerate over the next few years.

Liability Side

We can estimate the liability cost change by looking at expected fed fund rates, and how fast their deposit rates tend to adjust. The rate probabilities at the next few FOMC meetings:

Plotting the fed funds rate against their deposit cost allows us to get a good idea of the lag. The adjusted line just scales the deposit cost and shifts it downwards, in order to make the lag clearer. From this, we can see deposit cost tends to lag by ~2 quarters. Since the average expectation for the meeting on the 18/12/2024 is ~400bps, and empirically when rates move 100bps, deposits tend to move about 70, we can estimate that their deposit cost will drop by 90bps by June 2025. This would increase NIM by 47bps.

FHLB advances also make up a very substantial portion of HIFS’ liability side. While they have historically funded primarily with short-term advances, they have recently increased the proportion of longer-term advances in order to take advantage of their lower rates. In H1’23 the bank took on $785m of 2- and 5-year lender-callable advances, which were subsequently called in Q3 and turned over to callable 4, 5 and 7 year advances ($275m, $475m and $85m respectively). Unfortunately, they have not provided information on the maturity profile of the remaining advances ($724m at Q3’23) since the annual report - they were all < 1 year at that point, however it’s likely some of them are now longer. Therefore, the best I can do is guess - I’ll assume half of them are short-term, and will drop in line with fed rates. This gives a benefit of 130 * 724/4484 = 21bps.

Asset Side

Since rates began increasing in Q1’22, their average loan yield has increased 46bps, from 3.87% to 4.33%. Extrapolating that out to mid-2025 suggests another 39 bps of benefit. This works as a first-order approximation as only a fairly small portion of their loans have already repriced (maturity profile shown below), so the increase in base rates should continue to make its way through their loan profile without slowing down too much. A greater increase is also possible, as rates are higher now than the average since Q1’22 - but I think the most sensible assumption is just to keep that 39bps.

Additionally, any new loans made will bring the average rate up. Loans grew 7% YOY in Q4’23; the 5 year average is 14%, and the 10 year average is 14%. A conservative estimate is 9% per year, so 14% growth in loans by June ‘25. Given that their NIM has dropped roughly 250bps, new loans will likely be made at a rate at least 150bps higher than current loan rates (accounting for a foreseen drop in deposit costs). Thus, we can expect a 22bps benefit from these new higher yield loans.

Therefore, I predict that the NIM will have expanded by 47 + 21 + 39 + 22 = 129bps by mid-2025, to 2.19%. However, it’s important to understand that these estimates are based on market estimates of future interest rates, and if the fed takes longer than expected to lower rates, the NIM will be compressed for longer.

Projecting Earnings

With mid-2025 NIM crudely estimated, we can estimate earnings. Over the past 5 years, credit provision has averaged 0.08% of loans, which corresponds to 0.07% of assets given their current balance sheet. OpEx as a percentage of assets was around 0.70% in 2023, and should only improve with time as their asset growth has historically exceeded OpEx growth. Their income tax rate has averaged 27%.

(2.19 - 0.07 - 0.70) * 0.73 = 0.98% return on assets. Assuming assets grow 9% per year as before, we arrive at an annualised earnings power of $52m by mid-2025 (which would represent a return on equity of about 11%, and a P/E on current share price of 7).

Conclusion

Interest rate moves over the past couple of years have created an incredibly tough environment for the business model of HIFS. On top of that, a management which makes few mistakes made a significant blunder in taking on a large number of cheap loans just before rate hikes - and the market is giving them hell for it.

However, value is rarely found in the market’s darlings, and management blunders can create fantastic opportunities for those willing to swim against the tide. Hingham Institution for Savings is built for the long run, with very competent and shareholder-oriented managers at the helm, and in time it should return to historical returns on equity. While the earnings projection I’ve detailed inexorably has large error bars on it, it should at least illustrate that shareholders will not be waiting a decade for the whole loan portfolio to reprice in order to see strong performance once again.

On that basis, I believe that the current price of $170 per share (market cap ~$360m) represents an excellent buying opportunity for the patient investor and promises a strong long-term return, absent a major collapse of the US financial system.

Found this post useful? Subscribe to receive future write-ups straight to your inbox (it’s free!), or share the post with a fellow investor. Thanks!