Update on Vistry, the trouble child of my portfolio

Vistry has dropped 22% since I added it to the portfolio last month. I'm doubling down.

My write-up on Vistry was by far the most successful of anything I’ve published - almost 3,000 people have now seen it, and the blog’s subscriber count has quadrupled since posting. Moreover, I know of at least a couple people that bought shares after reading it. Seeing as it has dropped by almost a quarter since the post, I feel I at least owe you readers my thoughts on the developments.

Please remember - nothing on this blog is investment advice. No opinions expressed herein, regardless of how definitively they’re asserted, should be taken as fact, and I may have a financial interest in any of the companies mentioned. Do your own research, and if necessary consult a financial advisor.

What Happened?

First, the economy happened. With rates remaining high despite receding inflation, and the consumer still struggling through the cost of living crisis, private demand remained weak. Housebuilders as a group moved lower, with Vistry falling by about 8.5% from Nov 12th to Dec 23rd.

Then, Vistry announced its third profit warning in a single quarter, cutting their estimate for 2024’s adjusted operating earnings from £300m to £250m. They also announced they expected year-end net debt of ~£200m, up significantly from the <£89m estimated in the second profit warning (8th Nov), and the net cash position forecast that was maintained in the first profit warning (8th Oct). The stock promptly shed another 17% (incidentally, the same as the % reduction in profit forecast).

They gave 3 reasons for the profit warning:

Delays on some existing developments - revenue is recognised as development costs are incurred, so naturally a delay slows revenue recognition. It also reduces margin slightly, as the estimated total cost of the project will somewhat increase.

Their decision not to proceed with a number of proposed developments where the terms on offer were not sufficiently attractive - they have previously said they will not accept any development offering a project-level ROCE below 40%. It’s good to see they seem to be sticking to this despite having known another profit warning would destroy the share price. (Although, I am bearing in mind the possibility that they’re just telling investors what they want to hear - and really there just wasn’t a lot of demand)

A reduction in the rate of open market (private) sales on existing developments - though they clarify that this was a smaller effect

My Thoughts

When I read the profit warning, my first thought was ‘I should have seen this coming’. Okay, the delays would have been hard to predict, but the latter two points I probably could have foreseen.

I’ve been having a look at some other names in UK housebuilding. One of those is Watkin Jones (WJG.L - expect a write-up on in the next month or so). Like Vistry, they do a lot of build-to-rent stuff. And they have been STRUGGLING. From 2021 to 2023, their BTR gross margin dropped from a healthy 21.5% to just 9.5% - barely enough to cover overheads. Even now, they’re only targeting a 12% GM on new projects they take on. (You think VTY.L’s -60% from peak is bad? Try -92% on for style…)

The main reason for this, in my view, is the rise in interest rates - the 10Y gilt has risen from less than 1% for most of 2021 to over 4.5% now.

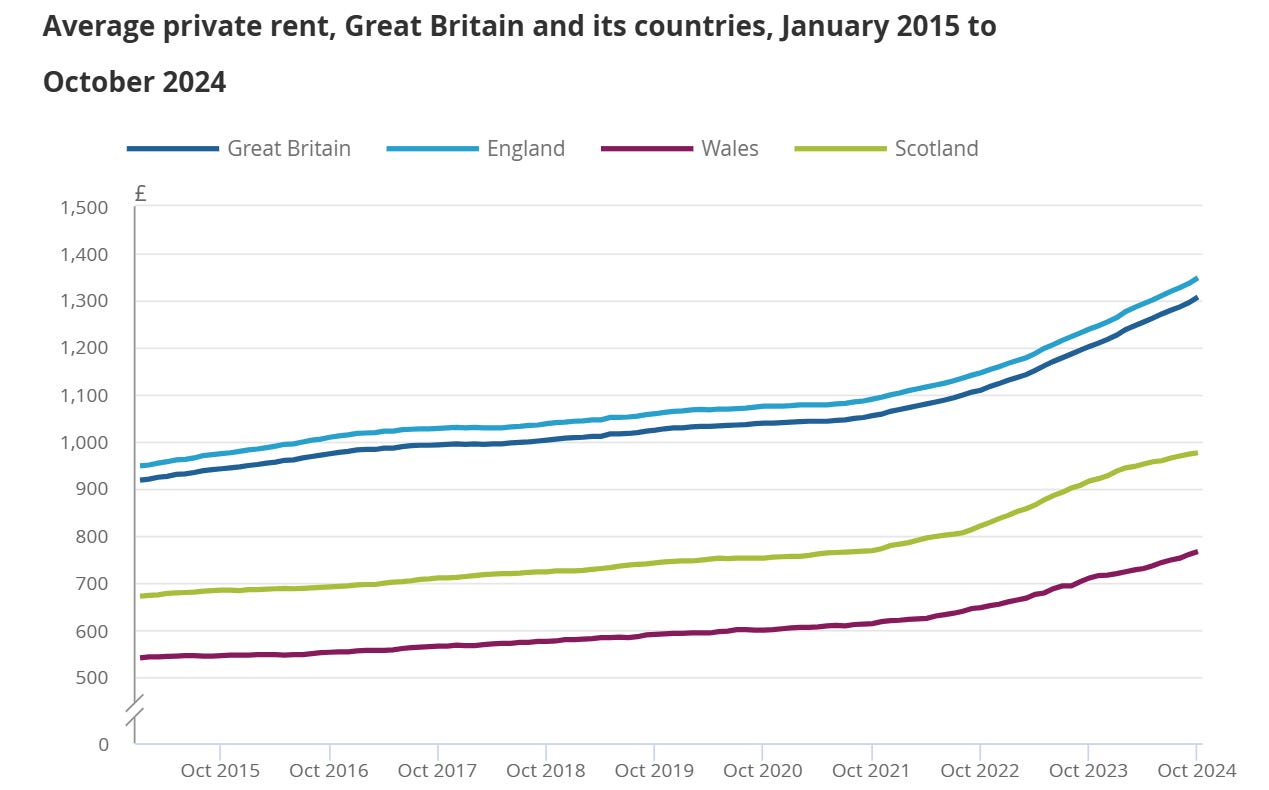

BTR essentially competes with gilts (or corporate debt) for institutional capital, so that’s a major blow. Rent growth has been strong lately, 25% in the last 3 years, but not yet enough to make up for rates:

Granted, BTR is only a minority of Vistry’s business (22% of units in H1’24; probably just below 30% of revenue) - but affordable likely isn’t having a whale of a time either. Something I should have mentioned in the original write-up is that many housing associations - the non-profits that buy and manage most affordable housing - are approaching interest coverage ratio limits, which may limit their ability to enter new partnership developments. Importantly, HAs take on long-term debt, 10-30 years, meaning they feel the effects of high rates gradually, as they refinance, rather than when the rates actually go up. That means even without taking on any new housing, their interest coverage ratio is dwindling right now.

I initially brushed this off. I figured there’s no way Labour lets the rate of new builds fall when increasing it was so central to their campaign - they’ll increase subsidies to affordable housing or allow a higher rate of rent increases if need be. And that anyway, for-profit Registered Providers (basically housing associations, but because they’re for-profit they can raise equity too) are growing quickly - they’ll be there to supplement any loss of demand from HAs.

The former point I still think is essentially true - my mistake here was neglecting to care what happens in the interim. The next AHP budget likely won’t be announced until mid-2025, and won’t kick in until March 2026. That’s a lot of time for results to worsen.

On the latter point, I don’t think I fully appreciated the effect rates are likely to have on FPRPs - the cost of equity goes up alongside the cost of debt when long-term rates rise, and certainly it shouldn’t be lower than the cost of debt. They’ll still broadly need rents to go up for investment to be worthwhile.

Finally, I don’t think I appreciated the impact that regulations in the last couple years around fire safety and energy efficiency have had on HAs’ finances. Vistry’s fire safety reserve was a whopping £280m as of June 2024, and that’s just for the units they’re currently developing - imagine how much worse it is for the housing associations with decades of housing on their hands. And the government seems content to make the HAs pay for the bulk of the energy efficiency upgrades, while they pour billions into hydrogen and carbon capture - two of the most uneconomical decarbonisation technologies out there. (Seriously, let’s stop trying to be the US - let Silicon Valley develop the technology and we can adopt it when it actually makes sense.)

Why did I miss this?

I think there are two answers to that. The first is that I was probably falling for a bit of the old ‘what you don’t know can’t hurt you’. I was aware that housing associations were coming under increasing financial pressure, but unable to quantify it because statistics around this stuff aren’t really available. Because of this, I think I failed to give it the consideration it deserved.

The second is that I’m not as familiar with this industry as I would like to be. One of the most basic and important Buffett rules is to invest within your circle of competence, and I don’t think this industry yet fits that description for me. My idea of truly being familiar with an industry involves knowing each of the publicly traded players well - having read each of their annual reports going several years back; having a decent grasp of each of their finances; understanding the strengths, weaknesses and idiosyncrasies of each; knowing which managements I like and which I don’t, and so on - plus being a regular reader of any relevant trade journals, understanding the economics of the industry’s suppliers and customers, and having a good grasp of the regulatory picture. Oh, and having regular conversations with people in various roles in the industry. It’s understandable that I’m not (yet?) at that level, seeing as I’m near the start of my investment journey, and only began studying the UK housebuilding industry to understand Vistry. But it means avoidable mistakes will likely be made.

This brings up a larger dilemma in the value investing world, which I don’t think gets enough attention. As a new investor, you have no circle of competence. Is the right move to simply pick an industry top-down, and dive headlong into it - knowing that by the time you know it well enough, there may be nothing undervalued there? Or should you do what I mostly find myself doing at the moment - stumbling around from industry to industry and country to country, whenever a compelling thesis catches my eye - and only then trying to learn the industry? It’s not an easy question. Perhaps I’ll write out my thoughts on it here sometime.

What should I have done?

This is also not an easy question. Even if I had fully appreciated all the things I’ve just said I failed to appreciate, I still would have thought the company was drastically undervalued. In that case, the decision to wait for another profit warning before buying would essentially have been me saying I think I have a better idea of where the stock is going in the short term than the market, which is something I usually emphatically disagree with.*

I don’t think the situation when I bought was sufficiently exceptional to warrant straying from that - there wasn’t good reason to believe my view was differentiated (hence not priced in). While for me the outcome would have been the same (though perhaps a slightly smaller position size), what I should have done differently was take more time to understand the company’s position, and be more cognisant of my biases. And then I should have presented the more complete picture of the risks to readers.

*Well, I suppose that’s not entirely true. The long term is made up of a series of short terms, and if I didn’t have an edge in any of them then I wouldn’t have an edge in the long term. But the edge is small enough in each of those short-term windows (assuming it exists…) that short-term trading is not a particularly viable strategy for me, since each idea takes so much work.

The CMA Investigation

On that note, something else which I neglected to discuss is the ongoing Competition and Markets Authority investigation into the housebuilding industry.

In February 2023, the CMA (the UK’s main competition regulator) began a study of the housebuilding market, after being prompted to do so by the DLUHC (now MHCLG - bloody acronyms). One of the reasons cited was that housebuilders have been generally more profitable than one would expect from a well-functioning market (i.e. ROE >> cost of capital), if you exclude the GFC - particularly during the 2013-2019 period. The report was published in February 2024 (summary, full report), with the headline conclusions (for us) being:

Housebuilders probably aren’t too profitable - it’s a cyclical business, so taking out the GFC isn’t completely fair; and the unusually profitable 2010s were likely just the result of rock-bottom interest rates and the Help to Buy scheme

Land banking isn’t the problem - there is generally ample land for sale, the selling process is competitive, there aren’t really regions where a very small number of developers control almost all the developable land, and developers don’t hold onto it without action for an disproportionate amount of time - the size of the land banks is more a symptom of the poorly designed planning process

Housebuilders build at the local “absorption rate” - the rate at which houses can be sold without reducing prices below the existing market price level. This practice is rational, as it allows them to maintain margin while reducing the amount of unsold housing sitting partially or fully complete (so maximises ROIC).

Large housebuilders are probably sharing some non-public info on pricing, sell rates etc., and this may somewhat weaken competition - though it likely isn’t a major contributor

Despite concluding information sharing not a major problem, the CMA decided to launch an investigation into the 8 largest housebuilders - Barratt, Bellway, Berkeley, Bloor Homes, Persimmon, Redrow, Taylor Wimpey, and Vistry - after publishing the report, saying anything that could weaken competitive forces is of concern to them.

The investigation was slated to run from Feb-Dec 2024, so should announce its conclusions any day now. I’d guess it will conclude something along the lines of “Yes, they were sharing some non-public data - while it probably didn’t have a meaningful negative effect on competition, it may have slightly disadvantaged those without access to it; moving forwards they will be scrutinised more closely, and have to decide between ceasing such communication or publishing the data publicly.” I don’t think there is a material chance the investigation finds anything disastrous, like collusion - there are just too many players, and pricing decided too far down the chain of command for that to be feasible (a similar argument to how faking the moon landings would have required upwards of 10,000 people keeping the secret).

However, it is possible that the findings are somewhat worse than what I suggested above, and that they spook the market - on the off chance that does happen, at least now any readers that own VTY won’t be blindsided.

What’s the move now?

Well, I’ve probably spoiled the secret by now, but I still think Vistry is criminally undervalued - even more so after this decline.

Don’t get me wrong, there could be a lot more pain. The affordable market will probably get worse before it gets better. But long-term, the UK simply needs more affordable housing, and Vistry is positioned very well to deliver it.

Pessimistic P/E Calculation

I gave my view of the underlying earnings power of the business in the original report, but I feel it would be helpful to give a more pessimistic calculation now, to assess the downside protection.

Vistry’s 2024, for which they’ve guided pre-tax adjusted profit of £250m, will include a roughly £105m charge to recognise the costs they understated in previous years. We’ll keep £30m of that for our run-rate calculation, to be conservative. Interest was originally expected to be £85m - net debt hasn’t come down as quickly as they’d hoped, so we’ll assume £100m. We’ll keep the same £40m per year in average exceptional costs. With their 29% tax rate, that’s £131m of net income (as a reminder, my original, rosier calculation turned up £266m, which I do still think is a better picture of normalised earning power).

We’ll knock the £1b they hoped to return to shareholders down to £500m, and take that off the market cap of £1.81b. That leaves us with a P/E multiple of 10, in a year I think few would deny is a down year. It’s not exactly a demanding multiple.

What about book value?

To really hammer the point home, let’s look at the value of the balance sheet - forgetting that this is supposed to be an asset-light model. They’ve got £323m of cash, £766m of receivables, £612m of investments in JVs (2/3rds loans, 1/3rd equity), £3,212m of inventory (land, WIP and a smidge of finished houses) and £78m of lease assets. Liabilities total £2,924m.

That leaves a TNAV of £2,067m. This asset-light housebuilder is literally trading below tangible book. For what it’s worth, the normal (asset-heavy) UK housebuilders typically trade at 1-2x TNAV.

Given that, I think it’s fair to say the downside is very well-protected here. And my view remains that the upside is large - I’d put conservative fair value at £12-18 here (slightly lower than in the original write-up), versus the current price of £5.57. That’s equally or more undervalued than the other shares in the VGV Portfolio, with lower risk, so I will be adding to the position.

Changes to the VGV Portfolio

At the next market open (30/12/2024), the Very Good Value Portfolio will reallocate roughly 10% from Airtel Africa and 15% from Kaspi into Vistry, increasing VTY.L’s allocation to 50% (and leaving the other two at ~15% and ~35% respectively, reflecting my view of the relative risk/reward pictures of the two). As a reminder, this is a virtual portfolio intended only for performance tracking - I would generally not throw 50% of my liquid net worth into a single stock - at least one with material risks like this. (My personal portfolio contains several other stocks and a fair bit of cash, so the concentration of Vistry is a fair bit lower.)

Please feel free to comment or message me with any questions - and happy holidays everyone :)

Great stuff Matt, thank you.

Anymore thoughts in light of the trading update on the 15th?

An interesting revelation to me was that the 'unattractive commercial deals' that came to light in the last profit warning were in fact related to land sales to other homebuilders and not related to unattractive return profiles on partnership deals (as it seems most people assumed including myself). Basically GF not wanting to be taken advantage of by competitors.

Whilst this is of course positive - as it suggests no inherent issue with the partnership model where terms aren't attractive for both parties - it does raise the question; is Vistry recording land sales as part of their operating profit? Maybe this doesn't come as a surprise to most people (Im new to this industry) as land is inherently a part of the main product they sell (houses on land) but in some ways I'm surprised that the sell-off of their land bank isn't included as part of an exceptional item.

To illustrate the point I have a position in a newspaper business that is transitioning to a digital-only model and as such is liquidating their printing press facilities as they move away from the legacy print business. The cash from this is recorded on the cash flow statement under 'investment activity' and never appears on the income statement as it is not part of their operating profit. It would be strange to me for them to include this liquidation as income in the same way its strange that Vistry now appears to be wanting to include its land liquidation as profit on the income statement (hence the profit warning).

Does this mean for example the previous £800m EBIT guidance includes land sales?

Am I misunderstanding something and does anyone have any thoughts on this?

Great write-up, much better value than those substack instilling FOMO trying to make subscription money! Good luck with your journey!